Dive Brief:

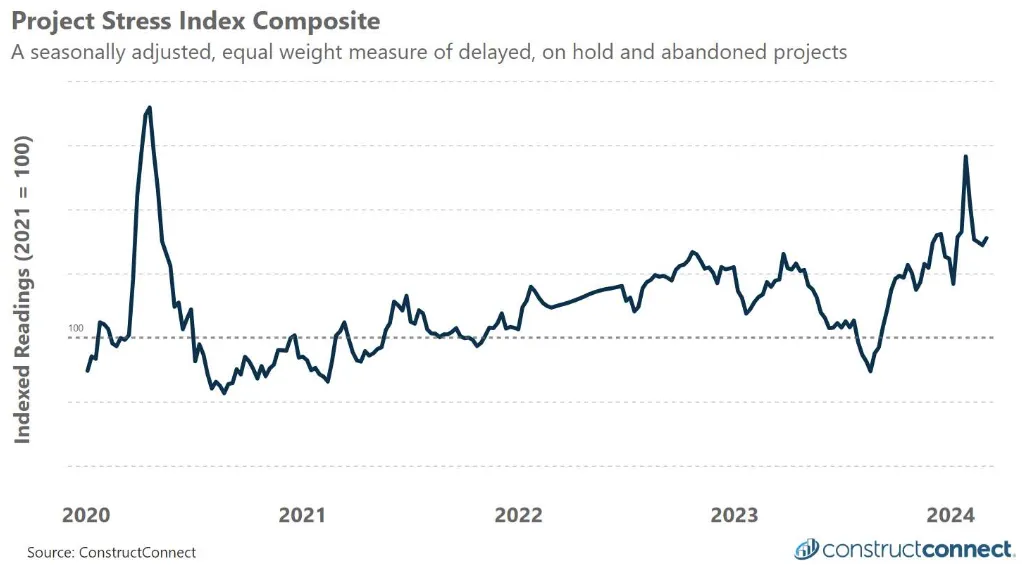

- The Project Stress Index — a measure of construction projects with a delayed bid date, or that have been paused or abandoned — rose 1.7% in the last 30 days, according to a March report from ConstructConnect, a Cincinnati-based provider of construction information and technology solutions.

- Work put on hold increased 11% over the previous 30 days through March 2, said Michael Guckes, senior economist at ConstructConnect. Compared to the same period in 2023, the project stress index remains up 13%, added Guckes, signaling ongoing uncertainty within construction.

- “At some point the market needs to rebalance and find its steady state. When this happens I believe the PSI trend will return to a generally horizontal orientation once again,” said Guckes in an interview. “Unfortunately, this may not happen quickly given the Fed’s latest decision to keep rates elevated.”

Dive Insight:

There were some positives in the short term. For example, delayed bid activity and abandoned projects fell 13% and 16%, respectively, from a month ago.

But public and private sector projects continue to show different patterns, according to ConstructConnect. While both face increasing delays and cancellations, public projects, due to their funding mechanisms, remain in a comparatively stronger position to push work forward.

On the public side, which includes infrastructure work, projects put on hold increased about 14% compared to the same week a year ago, according to the report. Projects in a degrading financial environment would likely be put on hold at first as owners try to assess alternatives before having no choice but to abandon a project, said Guckes.

Public abandoned projects jumped 70% in the week ending March 2 compared to the same week in 2023. Guckes said many municipalities and states could be looking at the high cost of construction today, coupled with high municipal bond rates, and simply realizing the costs are too great to start, said Guckes.

Nevertheless, he still expects the bulk of activity in the public sector to propel forward as the year goes on.

“There are a tremendous number of projects that must be acted on in the future. Those projects that instantly come to mind include power generation and transmission, water, sewer, road and bridge,” said Guckes. “These types of projects simply must be pushed through for the wellbeing of society regardless of the budgetary sacrifices that will have to be made elsewhere.”

The project stress index ticked up in March for public and private construction activity, according to ConstructConnect, a provider of construction information and technology solutions.

Courtesy of ConstructConnect

On the private side, projects put on hold nearly doubled compared to the same week a year ago, up about 94%, said Guckes. Project abandonments increased 9% over the same timeframe.

Guckes noted while a 9% jump may not be troubling on its surface, it comes after a tremendous surge of first-quarter private project abandonments in 2023. When comparing the latest week’s abandonments to the same period in 2022, abandonment activity increased 50%, according to ConstructConnect.

A recent example came when New York-based pharma giant Pfizer shut down construction earlier this month on a 270,000-square foot manufacturing facility in Everett, Washington. The move will impact approximately 120 employees who were setting up the site, the company said.

And the project abandonment rate could also continue to rise, said Guckes.

“If, for example, you are in the office segment today, what you are seeing are high vacancy rates, falling existing office building prices and banks that are fearful of adding more office commercial real estate debt to their books,” said Guckes. “Under this compilation of conditions there may simply be no path forward for many of the projects that generally fit this criteria.”

For improvement regarding private construction projects, Guckes says to keep an eye on financial indicators.

“I want to see loan officer surveys point to a greater willingness to make commercial real estate loans once again, and for commercial and industrial lending and commercial real estate credit delinquency metrics to stop rising since hitting lows in 2022,” said Guckes. “The pressure will come off the construction industry once existing commercial real estate price strength renews.”