Dive Brief:

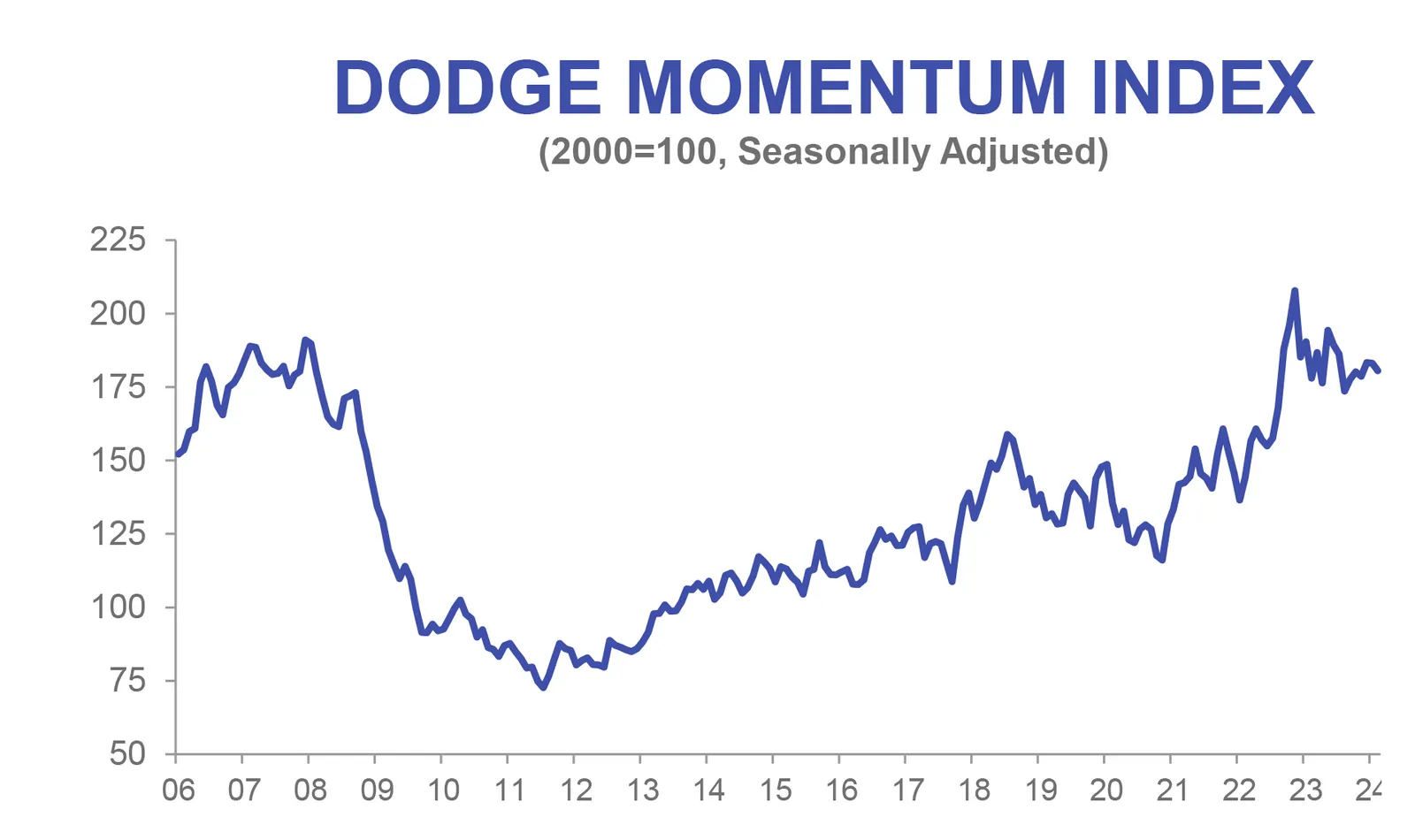

- The Dodge Momentum Index, a benchmark that measures nonresidential construction planning, fell 1.4% in February due to a lackluster reading in the office sector, according to the Dodge Construction Network. Over the month, commercial planning, which includes office construction, tumbled 2.3% while institutional planning ticked up 0.1%.

- The drop in February marks the first decrease since November, where weak commercial planning also dragged down overall planning levels, according to Dodge data.

- “However, the index remains 25% higher than where it was just two years ago,” said Sarah Martin, associate director of forecasting for Dodge. “Dodge remains optimistic that nonresidential planning will stay elevated throughout 2024 alongside rising confidence in 2025 market conditions.”

Dive Insight:

Weaker office and healthcare planning constrained nonresidential planning in February, but most other categories showed growth over the month, said Martin.

That should continue to improve, especially if the Federal Reserve decides to cut rates in the second half of this year, said Martin. Federal Reserve Chair Jerome Powell said recently he expects the Fed will begin to trim borrowing costs sometime this year if price pressures remain on a steady downward trend.

Until then, commercial planning, which includes office, hotel, retail and warehouse, will likely continue to drag down momentum in overall construction activity, according to Dodge. On the institutional side, which includes education, life sciences and healthcare, planning remained flat in February.

On a yearly basis, overall planning levels grew 1% since February 2023. The commercial segment dropped 10% lower, while the institutional segment jumped 27% over the same period, according to Dodge.

The Dodge Momentum Index, a benchmark that measures nonresidential construction planning, fell 1.4% in February, according to the Dodge Construction Network.

Courtesy of Dodge Construction Network

Architectural billings drop for 12 consecutive months

Along with the DMI, the Architectural Billings Index, a leading indicator for construction work nine to 12 months out, remained sluggish to start 2024, according to the most recent data from the American Institute of Architects.

Billings at architectural firms, which start their work in advance of actual construction, have now declined for 12 straight months. That marks the lengthiest period of declining billings since 2010 to 2011, although the pace of this decline is slower, according to ABI.

Nevertheless, inquiries into new projects continue to grow. While not a sign of immediate growth, that indicates clients remain interested in new projects, but are not yet prepared to commit to them, according the report.

That upbeat but noncommittal stance was reiterated in comments from one design firm in the South that specializes in commercial and industrial planning, which said its work was steady, but that markets were in flux due to a high cost of capital — another indication that owners may be waiting for anticipated interest rate cuts before pulling the trigger on jobs.

A total of 17 projects valued at $100 million or more entered planning in February, according to Dodge. The largest commercial projects included:

- The $220 million QTS data center in Fort Worth, Texas.

- The $150 million DOT transit maintenance facility in Boulder, Colorado.

The largest institutional projects to enter planning included:

- The $348 million Island Parkway life sciences campus in Belmont, California.

- The $304 million New York Presbyterian cancer center in New York City.