The Infrastructure Funding and Jobs Act will enhance exercise within the civil development area in 2023, in response to Dodge Building Community.

Dodge expects civil development begins, akin to public transit, roads, bridges, EV charging stations, water-related initiatives and energy vegetation, to complete $281 billion in 2023, a 16% leap from final 12 months. That’s as a result of infrastructure funds will steadily circulation into the market in 2023. By means of July 2022, solely a small fraction of infrastructure {dollars} have entered the market, in response to Dodge.

For instance, out of all of the IIJA {dollars} allotted for civil initiatives, solely 19% has made its option to roads and bridges initiatives, 21% to public transit initiatives, 15% to EV charging stations and 14% to water infrastructure, stated Department.

“There’s some huge cash nonetheless on the desk ready to be spent,” stated Department. “We proceed to suppose 2023 and 2024 are one of the best years for infrastructure development,” he stated, although it is potential that timeline might get pushed out by a 12 months.

Dodge’s forecast assumes that 85% of infrastructure cash might be spent by 2027.

For that cause, there stays a lot runway for development exercise within the civil area, stated Department. Nonetheless, questions stay whether or not the majority of that exercise will start in 2023, or get pushed out to 2024.

Under are the 2023 outlooks for freeway and bridge development, water-related infrastructure and energy vegetation.

Huge 12 months forward for freeway and bridge development

Public funding will proceed to help development exercise within the freeway and bridge sector, stated Department.

Over the previous 12 months, that cash began stretching throughout the U.S., stated Department. For instance, highway and bridge development in Texas jumped 40% in 2022 and accounted for 12% of all freeway and bridge development exercise within the nation. Different states, like Florida and South Carolina, have additionally seen surges in exercise during the last 12 months, stated Department.

Dodge pegs freeway and bridge development begins each to leap 20% in 2023 to achieve $94.4 billion and $26.6 billion, respectively. Collectively, that’s $121 billion price of exercise within the freeway and bridge sector in 2023, eclipsing 2022’s stage of $100.8 billion.

No recession issues for environmental public work exercise

The infrastructure enhance will boil over to environmental public works in 2023 as nicely, stated Department. That features water-related infrastructure, akin to dams, reservoirs and sewage.

Dodge expects begins within the sector to complete $68.8 billion in 2023, greater than a 14% leap from 2022.

Water provide techniques will lead work within the sector, with a projected $23.8 billion price of exercise in 2023, a 12% leap from a 12 months in the past. Reservoirs and sewage techniques intently observe, with about $22.8 billion and $22.2 billion price of exercise in 2023, a 15% and 17% improve from final 12 months, respectively, in response to Dodge.

“If we take into consideration infrastructure and the affect of the federal {dollars}, we’re not anticipating a lot change right here [due to] a recession,” stated Department. “A recession would decrease the demand for development staff and put extra downward stress on costs. So, if we had been to enter recession in 2023, it might imply right here for infrastructure that extra actual work truly will get finished for the {dollars} allotted.”

Extra demand for home energy and gasoline plant initiatives

The Inflation Discount Act will proceed to spice up the renewable power market in 2023, a boon for the facility and gasoline plant sector, in response to Dodge.

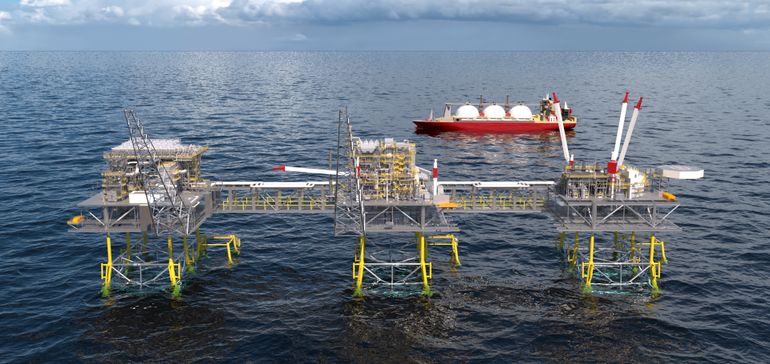

Dodge pegs the facility and gasoline vegetation class, which incorporates native utilities, wind vegetation, photo voltaic vegetation and LNG export services, to achieve $56.4 billion in 2023, a 7% improve from 2022’s stage of $52.5 billion.

Moreover, as extra European nations push to wean themselves off Russian pure gasoline, these firms would flip to U.S.-based LNG initiatives. For instance, LNG manufacturing off the coast of Louisiana can help the European Union’s purpose to finish its dependence on Russian fossil fuels, stated Jim Breuer, Fluor’s Power Options Group president, in an organization launch.

That ought to proceed to spice up exercise within the energy and gasoline plant sector nicely past 2023.

“There’s already been a much bigger buildout to [LNG] capability, however there might be much more,” stated Department. “However the course of to get these accredited is fairly lengthy, so I’d view that extra as a 2024 factor, somewhat than a 2023.”