Dive Transient:

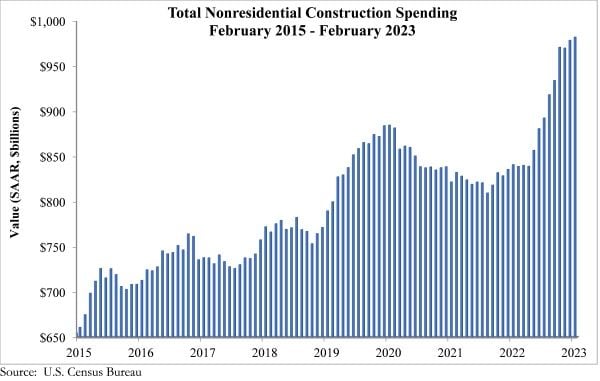

- Nationwide nonresidential building spending elevated 0.4% in February to a seasonally adjusted annualized foundation of $982.2 billion, in line with an Related Builders and Contractors evaluation launched Monday.

- Manufacturing initiatives predominantly accounted for the rise; spending within the different 15 nonresidential segments collectively declined in February, in line with Anirban Basu, ABC chief economist.

- “Nonresidential building spending elevated for the eighth time previously 9 months in February,” stated Basu. “Importantly, virtually the entire nonresidential sector’s momentum is attributable to manufacturing-related building, which accounted for practically 35% of the year-over-year progress in spending.”

Dive Perception:

From the broader perspective of complete building spending, which incorporates housing, expenditures decreased 0.1% in February on account of declines in single-family constructing and public building, in line with a report from the Related Common Contractors of America launched Monday.

The AGC additionally reported that spending on manufacturing building shielded total building spending from a bigger decline. Spending on manufacturing crops jumped 2.7% in February, in line with the AGC report.

“Continued sturdy demand for manufacturing crops and information facilities, together with a rise in energy initiatives, contributed to the rise in non-public nonresidential building,” stated Ken Simonson, AGC chief economist. “These segments seem more likely to continue to grow for a lot of months to come back.”

Non-public nonresidential spending inched up 0.7%, whereas public nonresidential building spending decreased 0.2% in February, in line with the ABC report.

Although the outlook for manufacturing building stays sturdy, issues round financing might dampen spending within the different nonresidential sectors, stated Basu.

“Whereas the manufacturing phase ought to proceed to see elevated ranges of funding, tightening credit score circumstances will probably hinder nonresidential building momentum within the close to time period,” stated Basu. “Contractors keep a well being degree of backlog… however a dismal financial outlook and problem securing financing are potential headwinds for the trade for the remainder of 2023.”

Courtesy of Related Builders and Contractors

That uncertainty round building financing is already bleeding into spending information.

For instance, spending declined on a month-to-month foundation in 9 of the 16 nonresidential subcategories, in line with the ABC report. Water provide spending decreased 1.2% in February, whereas industrial building dropped 0.7%.

The most important public classes posted combined outcomes as properly, in line with AGC. As an example, freeway and road building spending ticked up 0.3%, whereas training building fell 0.9%.

Courtesy of Related Builders and Contractors