Sam Zell, a real estate titan and the founder and chairman of Chicago-based REIT Equity Residential, died Thursday at age 81.

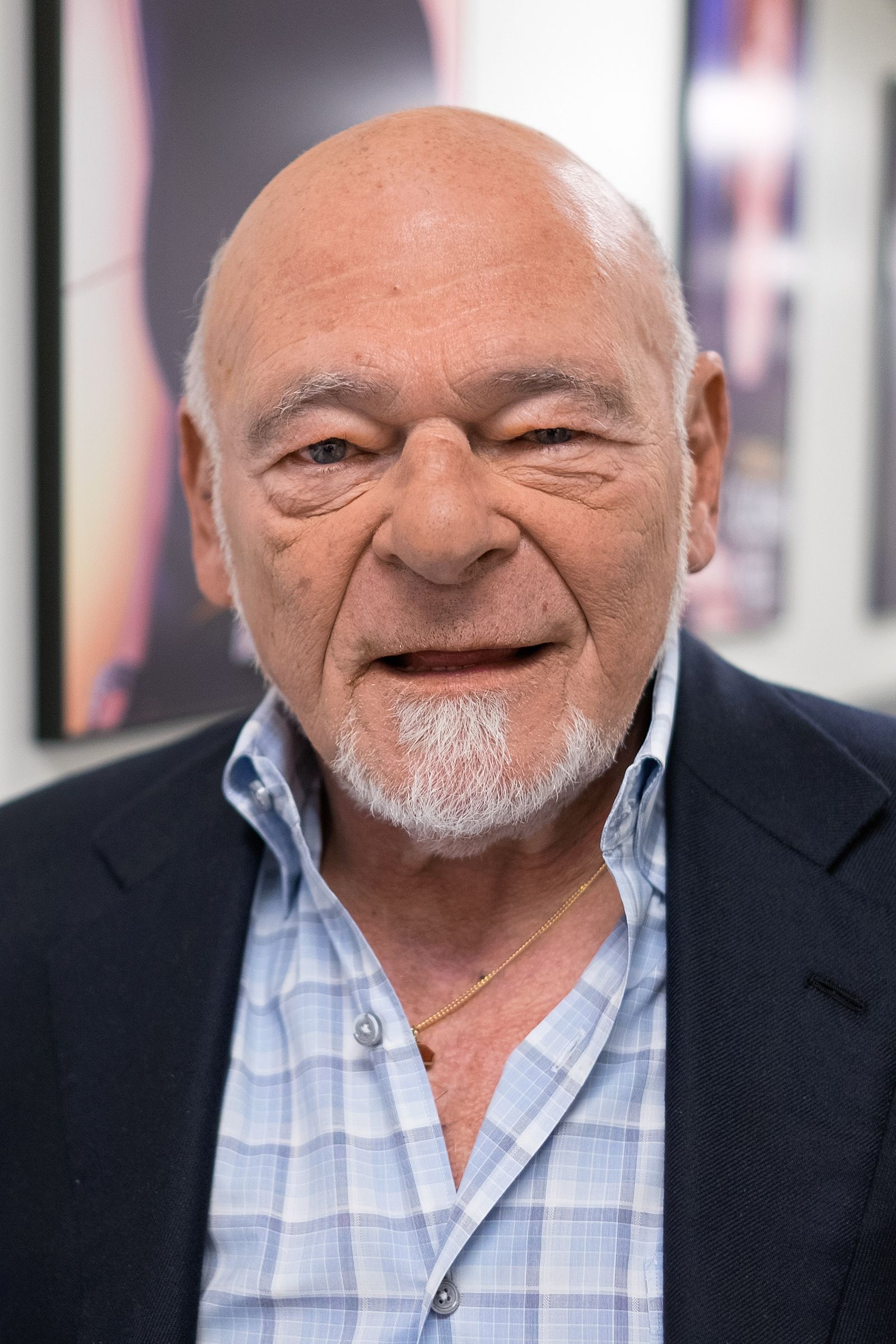

Sam Zell

D Dipasupil via Getty Images

At the news of his passing, those who worked with Zell or for rival commercial real estate firms expressed their admiration for his trailblazing work.

“To me, the mark of great leaders is that they surround themselves not only with smart people, but they create an environment for those smart people to be able to thrive,” said Doug Bibby, former president of the National Multifamily Housing Council. “And that’s what Sam Zell did.”

He earned respect from Chicago-area competitor Greg Mutz, who took his own company, AMLI Residential, public in 1994 before it was privatized in 2005. Mutz, AMLI’s current chairman and CEO, called Zell a visionary and a creative dealmaker who built EQR into a “premier, outstanding” REIT.

“I have competed against Sam Zell my entire business life and I can attest that is no easy feat,” Mutz told Multifamily Dive. “Sam Zell is a tenacious competitor and has put more points on the board during his lifetime than anyone I know in the real estate industry.”

David J. Neithercut, who served as EQR’s CEO from 2006 to 2018, will replace Zell as chairman of the EQR board effective immediately.

“Sam spent decades creating value for the investors in Equity Residential and his many other enterprises. It was my great privilege to work closely and learn from him for more than 35 years and my honor to succeed him as chairman of Equity Residential,” Neithercut said in a press release announcing Zell’s passing.

A wide-ranging career

Zell, who began investing in real estate in the 1960s, founded Equity Finance and Management Co., the predecessor company to EQR, while he was a student at The University of Michigan in 1969. Zell and fraternity brother Robert Lurie bought properties from developers who were saddled with high interest rates in the 1970s.

He bought more properties after the Savings and Loan Crisis of the 1980s, which only added to his growing reputation as “the grave dancer” who was able to bring struggling properties back to life.

After Equity Finance and Management Co. became Equity Residential, Zell took the company public in August 1993. He built the company into a $31 billion apartment owner, developer and operator and S&P 500 member. This year, it was No. 6 on the National Multifamily Housing Council Top 50 owners list with 79,322 units.

“The world has lost one of its greatest investors and entrepreneurs,” said Mark J. Parrell, Equity Residential’s president and CEO, in a press release. “Sam’s insatiable intellectual curiosity and passion for dealmaking created some of the most dynamic companies in the public real estate industry. He was a generous philanthropist and an incredible mentor and friend and will be missed by all who were lucky enough to be part of his extraordinary world.”

A sense of humor

Zell’s reach was wider than just the multifamily industry. He spent three decades building his Chicago-based Equity Office into the nation’s largest owner and manager of office buildings before selling it to Blackstone Real Estate Partners, an affiliate of The Blackstone Group, in a transaction valued at approximately $36 billion in 2006.

The EQR founder also invested and grew businesses in multiple industries, including manufacturing, retail, travel, healthcare, energy and even media, where he bought newspaper giant the Chicago-based Tribune Co. for $13 billion in 2007. A year later, the media firm filed for bankruptcy.

Zell was also an active philanthropist with a focus on entrepreneurial education, establishing the Zell/Lurie Institute at the University of Michigan; the Zell Fellows Program for entrepreneurship at Northwestern University’s Kellogg School of Management; the Samuel Zell & Robert Lurie Real Estate Center at the University of Pennsylvania’s Wharton School and the Zell Entrepreneurship Program at Reichman University (formerly IDC Herzliya), a private higher education institution in Israel.

Ric Campo, CEO of Houston-based REIT Camden, recalled their times skiing and relaxing together. “I think that what was most interesting about this guy is not only his amazing intellect and curiosity about the world, but he was also really fun,” he said.

Mutz also noted Zell’s sense of humor and impact on the Windy City’s real estate community. “This is a huge loss for Chicago and the entire real estate community,” Mutz said. “Sam Zell was a legend in his own time…. Sam Zell will be terribly missed.”

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.