Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

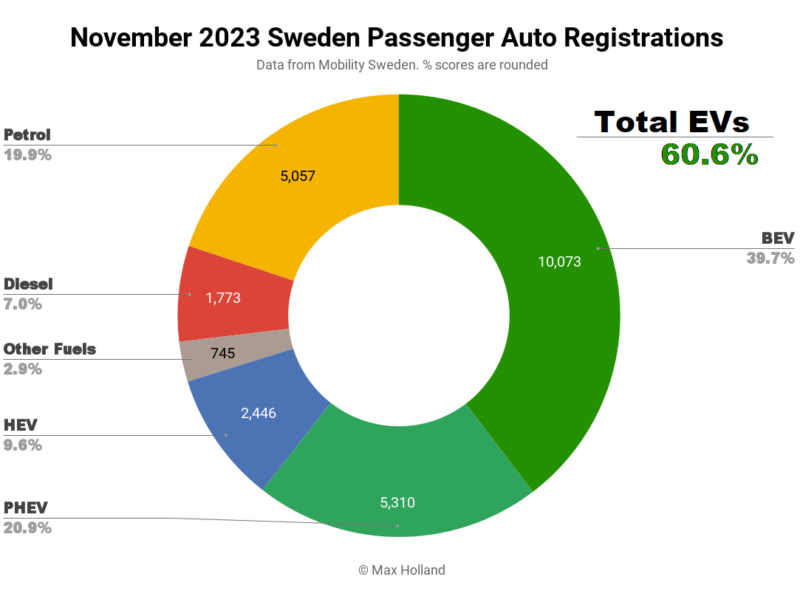

November saw plugin EVs take 60.6% share in Sweden, down YoY from the (anomalous) 64.6% pull-forward in November 2022. Full electrics alone took 39.7% of the market. Overall auto volume was 25,404 units, down 1% YoY. The Tesla Model Y was the best selling electric vehicle in November.

November’s auto market saw combined EVs take 60.6% share, comprising 39.7% full electrics (BEVs), and 20.9% plugin hybrids (PHEVs). These compare with YoY figures of 64.5%, with 42.5% BEV, and 22.1% PHEV.

Recall that November and December 2022 saw a relatively large pull forward in plugin sales (and market share), ahead of a significant incentive cut from January 1st. Due to this unusually high baseline, the YoY comparison is atypical this month.

Setting aside this November-December baseline blip, by looking at cumulative year-to-end of October figures, BEVs, are still growing strongly over 2022. They are up YoY in volume 23.1% to 81,216 units, and up in market share, from 29.1% to 38.6%. PHEVs, on the other hand, were down YoY in volume by 7.7% to 48,651 units, and down in share from 23.2%, to 20.7%.

This plateau-and-fade of PHEVs is expected as the Swedish market is entering the later stages of the EV transition, with robust DC infrastructure, BEVs no longer seen as avant-garde, etc.

Mobility Sweden is still concerned that the cancellation of the ecobonus on future orders, implemented a year ago, was premature. This amounts to saying that the speed of the transition (the slope of the curve) will suffer as a result. Since the market is still arguably in the hang-0ver of this change, especially for consumer sentiment, we will have to wait until at least 2024 Q2 to get a sense of any significant shifts in trajectory.

Meanwhile, traditional combustion-only powertrains (combined) spent their 4th consecutive month below 30% market share, currently at 26.9%. Diesel-only is particularly hard-pressed at 7.0% share, its second lowest ever (from the anomalous December ’22).

BEV Bestsellers

Tesla is back from its logistics ebb, and the Model Y was November’s best seller again, with 1,236 units. The runners up were the Volvo XC40, and the Volkswagen ID.4.

Of the familiar faces, only the Volvo XC40 was on a notable up-trend, having grown volume every month since July. This may be due to more demand for the recently updated version (slightly larger battery, more efficient, more range, faster charging), and/or greater production capacity.

Further down the ranks, the Tesla Model 3 has also started to pick up volume compared to subdued recent months, again likely due to the new “highland” updates. The Hyundai Ioniq 5 also saw personal-best volumes in November, in this case likely due to generous supply allocation.

Perhaps the most impressive performance is from the new Kia EV9, which only just debuted in October with a modest 16 units. It has now jumped up to a substantial 322 units, and gained 8th place! Let’s wait and see if this is a one-off case of mass batching in fulfilment of long standing orders, or a steady level of monthly demand.

Much further back, in 43rd spot, the BYD Dolphin, which also debuted in October (2 units), stepped up its volume to 25 units in November. One of the best value “relatively affordable” BEVs on sale (priced from 359,900 krone / €30,429), and a direct competitor to the already established MG4, let’s see how far the Dolphin can climb.

There was one new BEV model making a Swedish debut in November, the Volkswagen ID.7, which broke the ice with an initial 72 units. Priced from 664,900 krone (€58,550), the ID.7 is a large E-segment sedan, almost as long as the Tesla Model S (4,961 mm vs 5,021 mm), and is the new flagship vehicle of the Volkswagen brand, replacing the Arteon.

Even the ID.7 entry variant scores an impressive WLTP range of 621 km from its 77 kWh (usable) battery. There’s an 86 kWh (700 km WLTP) more powerful variant coming later. Both can recharge 10% to 80% in around 28 minutes.

Now let’s check up on the longer-term picture:

Over the trailing 3 months, the Tesla Model Y has maintained its strong lead, delivering 4,907 units, well ahead of the Volvo XC40, and Volkswagen ID.4.

Year to date, the Tesla is the overall best selling vehicle in Sweden, with 15,314 units delivered. This is far ahead of the Volvo XC40 at 11,639 units (all powertrain variants combined), and the BEV runner up Volkswagen ID.4 (9,636 units).

The Volvo XC40 BEV has climbed well recently, up to 3rd from 8th in the previous period (June to August). Also climbing recently is the Kia Niro, now in 6th spot, from 10th previously. Due to the aforementioned lull during the recent refresh, the Tesla Model 3 is still just outside the top 20 (25th), but we can expect to see it rejoin as soon as next month.

If the Kia EV9 can maintain momentum, next month will see it join the top 20 too.

Outlook

The overall Swedish economy has worsened, with Q3 showing a 1.4% YoY GDP drop. Inflation remains high at 6.5%, and interest rates remain high at 4%. Manufacturing PMI improved somewhat, to 49.0 points in November, from 46.2 in October.

Industry body, Mobility Sweden, said that “The industry’s internal order statistics show a sharp slowdown in new orders during the year and that electric cars are the powertrain that declines the most. This is something that has already started to be seen in the registration statistics and will become increasingly clear over the next year. It is strongly linked to the fact that it has been a year since the climate bonus was removed, and the state of the economy.” (Machine translation).

We have seen that the actual volume of BEV sales has held up okay so far in 2023, but the implication from Mobility Sweden is that the order books are now running dangerously low, and that this will soon start to be seen in delivery volumes.

There is also, however, the situation where orders are being fulfilled more quickly now, due to most of the previous supply chain delays being resolved. Tesla, for example, has an insignificant waiting process for the Model Y, which now mainly comes from the Berlin Factory, and is able to deliver in as little as 2 to 3 weeks after ordering, according to Tesla’s website. That makes for a short order book. The Model 3, coming from China, takes a bit longer — 3 to 6 weeks.

We know that battery prices have recently resumed their downwards trend, so there is surely room for manufacturers to sharpen up their pricing a bit, if demand does start to slip. Of course Mobility Sweden, representing the auto industry, regularly calls for the return of incentives, and would prefer to avoid price cuts. We will keep tracking the market to see how it all plays out.

What is your perspective on Sweden’s EV transition? Please jump into the comments section and join the discussion.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

CleanTechnica Holiday Wish Book

Our Latest EVObsession Video

https://www.youtube.com/watch?v=videoseries

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.